Left Curve: An Unconventional Yet Effective Investment Philosophy for Bull Markets

Table of contents

No headings in the article.

There are three types of investors: those who know nothing, those who know some things, and those who know everything. There’s no edge in the middle. Either know nothing or know everything.

What is “Left Curve” and why has it been such an effective strategy this year?

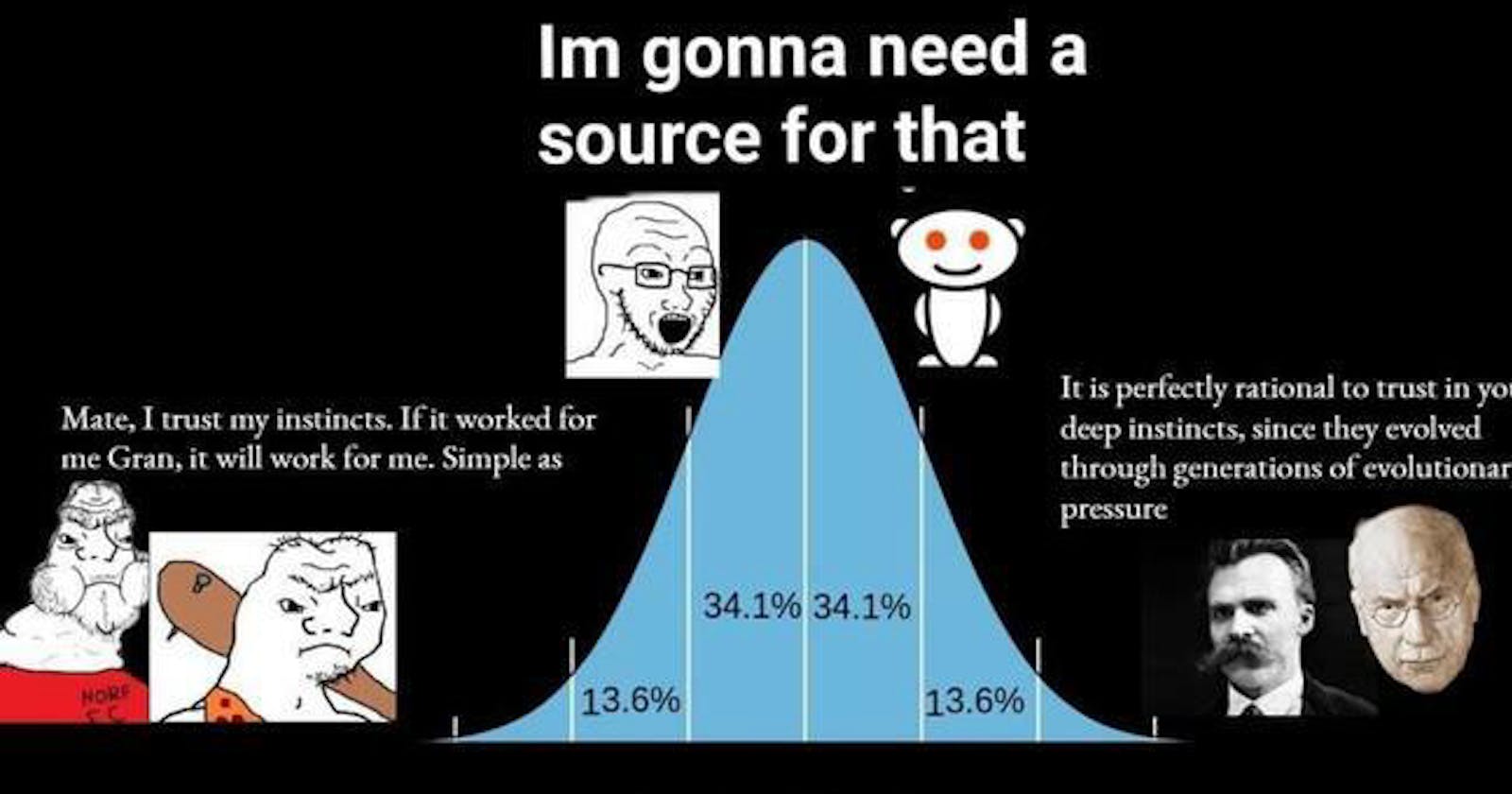

For those unfamiliar, “Left Curve” thinking originated from the meme above.

Most people get caught in the middle of the curve, the so-called “mid curve,” but why?

Well, we all like to think we are somewhat intelligent and logical, and in reality, we are. However, sometimes that can hurt us more than help us.

In the wild world of meme coins, sometimes less is more. Sometimes, less means literally less IQ, less thought, less reason, and more impulsiveness.

Now, this is a bit touchy because you should NOT be impulsive with your money. You should NOT buy meme coins with the intent to profit. I’m still encouraging you to do your due diligence and research. Make responsible decisions. I have to say these things, but ANYWAY, back to business…

Look at Harry Potter Obama Sonic Inu 10 token.

Harry Potter Obama Sonic Inu 10 token

This is by far the stupidest meme coin we have seen. The name is long, dumb, and confusing. The branding is absolutely hideous. The website looks like a scam. Their NFTs are genuinely scary. Yet, one of the most beloved meme coins of 2023. Why?

Who cares why? That’s kind of the whole idea of “Left Curve.”

It’s funny. Boom, there is your why. It makes you laugh when you think about it. Boom, there is your why. Sometimes, all it takes is one dumb reason for something to work.

Not everything needs utility. Not everything needs an existing meme. Not everything needs good devs. Not everything needs good art. Not everything needs everything. Some of the best plays in 2023 just have one thing, and that one thing clicks with people.

wif

Take $PEPE, wif, for example. Everybody loves this, and the token doesn’t actually do anything, but it represents the love for Pepe in the crypto community. That’s ALL it needs. Some people can’t wrap their heads around the idea of enjoying something that doesn’t solve anything.

pepe

People have really gotten behind meme coins. It’s easy to see why… they are fun. People love fun. People love to gamble, people want to 10x. Meme coins are here to stay, and if you can see it from a “Left Curve” viewpoint, it makes way more sense.

During a bull market, attention becomes the driving force, and meme projects excel at capturing it as everyone aims for that elusive 10x return, leading to a frenzy of investment.

The narratives that resonate best with retail investors in this cycle are likely to be memes, AI, and DePin, as these are concepts they can easily grasp.

The more complex a project’s narrative, the less likely it is to gain retail investment, as simplicity and relatability are key factors in attracting the masses driven by FOMO and the pursuit of quick gains.

If you know more about crypto it is hard to be a left-curve investor, Mint this NFT to remain your self to be a left-curve investor in a bull market.

This is not financial advice, this is for informational purposes only and is not intended to be personal financial advice, and I will not be liable for decisions you make.